How to Convert JSON File to Excel for GSTR 1?

- 7 Aug 25

- 5 mins

How to Convert JSON File to Excel for GSTR 1?

Key Takeaways

- GSTR-1 data is downloaded in JSON format, which is not human-readable and requires conversion for better usability.

- Converting JSON to Excel enables easier review, verification, and error-checking of GST data like invoice numbers, GSTINs, and amounts.

- The Excel utility tool allows seamless conversion by simply uploading the JSON file and clicking ‘Convert’.

- Only B2B invoices are supported in the utility; other categories like B2C, exports, or HSN require checking via the GSTN portal.

- Using this conversion method improves GST compliance and streamlines the return filing process for businesses and consultants.

Nowadays, businesses need to maintain accurate and structured records of all their processes. The government also promotes this for seamless reporting in future cases. As a part of this structured manner, the conversion of GSTR-1 JSON to Excel utility becomes essential.

So this blog will inform you about the exact process of how to convert JSON files to Excel for GSTR 1, offering you a practical solution.

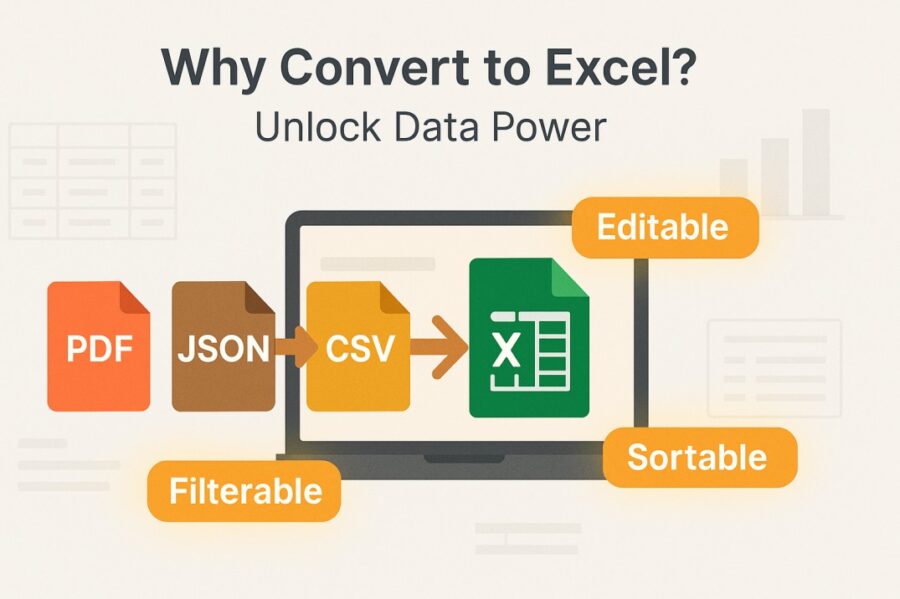

Why is There a Need to Convert Files in Excel?

The requirement for entering data in GSTR-1 is specific. This format calls for accuracy. After the filing of GSTR-1, when the data is downloaded by the taxpayer, the file is downloaded in JSON format, which is JavaScript Object Notation.

This format presents difficulty in reading and also requires tools such as JSONLint and JSON Editor Online. Therefore, many taxpayers/businesses convert the downloaded file from JSON format to Excel format for higher reliability. This ensures that the data is in a more structured, easy-to-read format.

How to Use the GSTR-1 JSON to Excel Utility?

To use the GSTR-1 JSON to Excel utility, you can follow these steps:

- Firstly, open the Excel workbook containing the utility and make sure that you have enabled macros.

- As you open it, a prompt will ask you to select your GSTR-1 JSON file.

- Then you click ‘Browse’ to locate and select your GSTR-1 JSON file from your device.

- After this, you just need to select the ‘Convert’ button and let the utility process convert the JSON data into a structured Excel format.

- Finally, after the processing is complete, you will need to save the converted Excel file to your preferred location on the system.

- Open the saved Excel file and review the invoice details such as invoice numbers, GSTINs, values, dates and more.

Note that the utility supports only B2B invoices. For B2C transactions, amendments, exports or HSN summaries, you will need to refer to the GSTN website.

How to Convert JSON File to Excel for GSTR 1?

To convert JSON file to Excel for GSTR 1, you can follow these steps:

- Firstly, you will need to drop or upload file which is originally in JSON format and click on the ‘Convert to Excel’ button.

- After the conversion is complete, click on the ‘Download Button’ to obtain your file in Excel format.

Conclusion

Efficient GST compliance depends not just on accurate data but also on how easily one can access and interpret it. By converting the data from JSON to Excel, businesses can conveniently transform their information into a familiar format for better understanding and verification.

Therefore, knowing how to convert JSON files to Excel for GSTR 1 can significantly simplify your filing process, whether you are a tax consultant or a business owner. It will also ensure better control over your GST reporting.